Nike’s Business Overview

Nike, Inc. is a multinational corporation that designs, develops, manufactures, and sells footwear, apparel, equipment, accessories, and services worldwide. It is the world’s largest supplier of athletic shoes and apparel, with a strong brand recognition and a global distribution network.

Core Business Activities and Target Market

Nike’s core business activities are focused on designing, developing, and marketing athletic footwear, apparel, and equipment. The company’s primary product lines include running, basketball, soccer, training, and sportswear. Nike targets a wide range of consumers, from professional athletes to casual fitness enthusiasts.

Competitive Advantages

Nike’s competitive advantages include:

- Strong brand recognition:Nike has established a powerful brand image and enjoys a high level of consumer trust and loyalty.

- Product innovation:The company consistently invests in research and development to create innovative products that meet the evolving needs of athletes and fitness enthusiasts.

- Global distribution network:Nike has a vast global distribution network, enabling it to reach consumers in virtually every major market.

- Effective marketing campaigns:Nike is known for its creative and engaging marketing campaigns that effectively target its target audience.

- Strong athlete endorsements:The company has a long history of sponsoring and endorsing top athletes, further enhancing its brand image and credibility.

Recent Strategic Initiatives

Nike has been focusing on several strategic initiatives in recent years, including:

- Digital commerce:The company is investing heavily in digital commerce to enhance its online presence and reach a wider audience.

- Sustainability:Nike is committed to reducing its environmental impact and promoting sustainable practices throughout its supply chain.

- Direct-to-consumer (DTC) strategy:Nike is expanding its DTC channels to gain more control over its distribution and customer relationships.

- Personalization:The company is leveraging data and technology to offer personalized experiences and products to its customers.

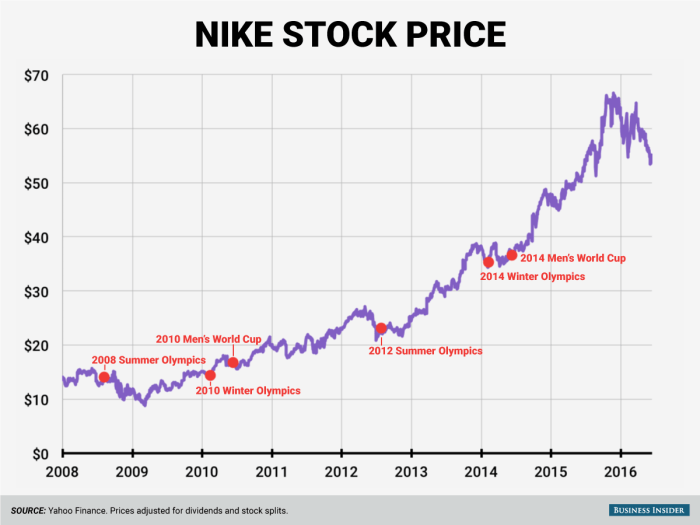

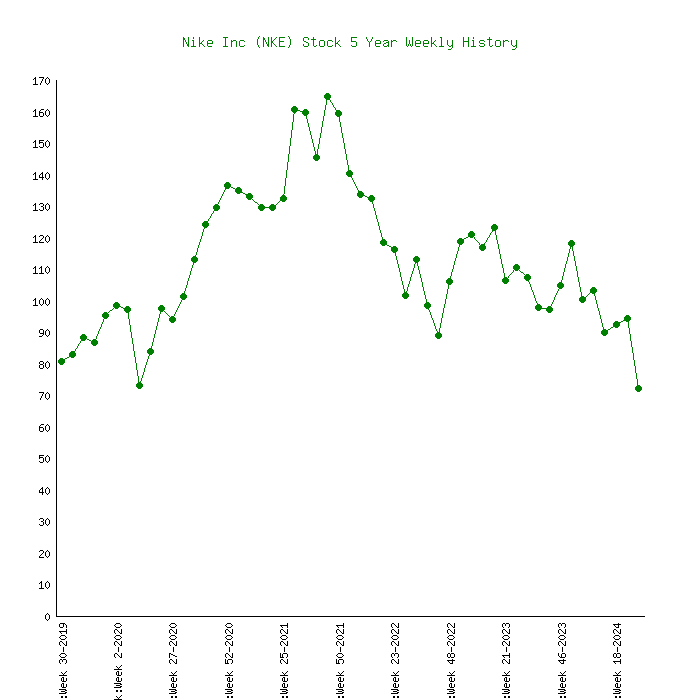

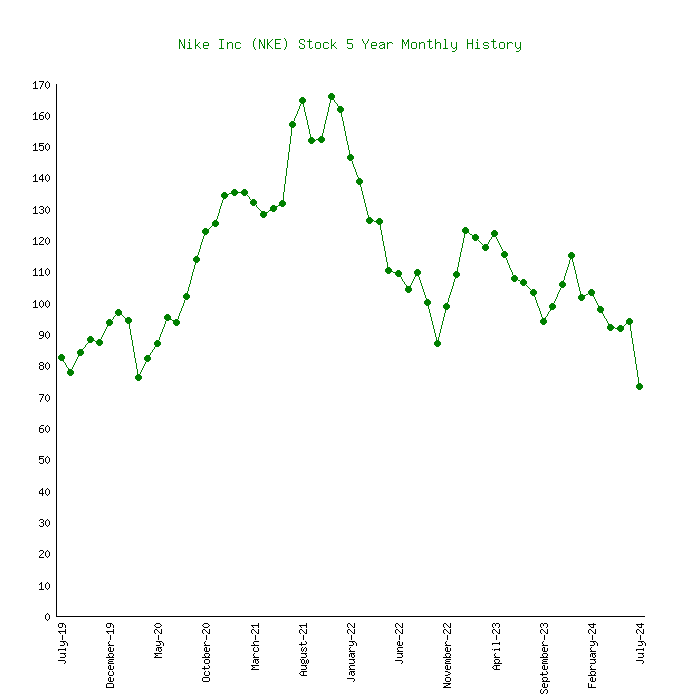

Financial Performance Analysis

Nike has consistently delivered strong financial performance, demonstrating its ability to generate revenue growth, profitability, and cash flow.

Key Financial Metrics

- Revenue Growth:Nike has experienced steady revenue growth in recent years, driven by strong demand for its products and expansion into new markets.

- Profitability:The company has maintained high profitability margins, reflecting its efficient operations and pricing power.

- Cash Flow:Nike generates significant cash flow from its operations, which it uses to invest in growth initiatives, return capital to shareholders, and manage its debt.

Comparison to Industry Peers and Historical Trends

Nike’s financial performance compares favorably to its industry peers. The company has consistently outperformed its competitors in terms of revenue growth, profitability, and market share.

Factors Influencing Financial Performance

Several factors have influenced Nike’s financial performance in recent years, including:

- Global economic conditions:The global economic environment, including consumer spending patterns and currency fluctuations, can impact Nike’s sales and profitability.

- Competition:The athletic footwear and apparel market is highly competitive, with several strong rivals vying for market share.

- Supply chain disruptions:Global supply chain disruptions, such as those caused by the COVID-19 pandemic, can impact Nike’s production and distribution operations.

- Consumer preferences:Nike’s financial performance is also influenced by changing consumer preferences, such as the growing popularity of athleisure and the increasing demand for sustainable products.

Market Factors and Industry Trends

The global athletic footwear and apparel market is a large and growing industry, driven by several factors.

Growth Drivers

- Rising disposable incomes:As disposable incomes increase in emerging markets, consumers have more discretionary spending available for athletic footwear and apparel.

- Growing health and fitness awareness:There is a growing awareness of the importance of health and fitness, driving demand for athletic products.

- Popularity of athleisure:Athleisure, the trend of wearing athletic clothing in casual settings, has boosted demand for comfortable and stylish athletic apparel.

- E-commerce growth:The rise of e-commerce has made it easier for consumers to purchase athletic products online, driving sales growth.

Challenges

- Economic uncertainty:Global economic uncertainty and volatility can impact consumer spending on discretionary items like athletic footwear and apparel.

- Competition:The athletic footwear and apparel market is highly competitive, with several established brands and emerging players vying for market share.

- Supply chain disruptions:Global supply chain disruptions can impact production and distribution, leading to delays and higher costs.

- Sustainability concerns:Consumers are increasingly concerned about the environmental and social impact of the fashion industry, putting pressure on companies to adopt sustainable practices.

Emerging Trends

- Personalization:Consumers are increasingly demanding personalized experiences and products, leading to a growing trend of customized footwear and apparel.

- Digital innovation:Technology is playing an increasingly important role in the athletic footwear and apparel industry, with companies using digital tools to enhance product design, manufacturing, and customer engagement.

- Sustainability:Sustainability is becoming a key differentiator in the industry, with consumers increasingly favoring brands that prioritize ethical and environmentally friendly practices.

Competitive Landscape

Nike faces competition from a range of established and emerging brands in the athletic footwear and apparel market.

Key Competitors

Nike’s key competitors include:

- Adidas:Adidas is Nike’s primary competitor, with a strong global presence and a focus on innovation and sustainability.

- Puma:Puma is another major competitor, known for its stylish designs and partnerships with celebrities and athletes.

- Under Armour:Under Armour is a relatively newer competitor that has gained significant market share through its focus on performance apparel and innovative technologies.

- New Balance:New Balance is a well-established brand known for its high-quality footwear and its focus on comfort and performance.

- Reebok:Reebok is another established brand that has recently been revitalizing its product line and marketing efforts.

Competitive Strategies

Nike’s competitors employ a variety of competitive strategies, including:

- Pricing:Competitors use different pricing strategies to appeal to different customer segments, ranging from premium brands to value-oriented options.

- Product innovation:Competitors invest in research and development to create innovative products that meet the evolving needs of athletes and fitness enthusiasts.

- Marketing:Competitors use a variety of marketing channels to reach their target audiences, including traditional advertising, social media, and influencer marketing.

- Distribution:Competitors have different distribution strategies, ranging from direct-to-consumer channels to partnerships with retailers.

Potential for Future Competition

The athletic footwear and apparel market is constantly evolving, with new competitors emerging and existing players adapting to changing consumer preferences. The rise of direct-to-consumer brands and the growing popularity of sustainable products are creating new opportunities and challenges for Nike and its competitors.

Risk and Opportunities

Nike, like any publicly traded company, faces a range of risks and opportunities that could impact its future performance.

Key Risks

- Supply chain disruptions:Global supply chain disruptions, such as those caused by geopolitical events, natural disasters, or pandemics, can impact Nike’s production and distribution operations.

- Economic downturns:Economic downturns can lead to reduced consumer spending on discretionary items like athletic footwear and apparel, impacting Nike’s sales and profitability.

- Changing consumer preferences:Nike’s business is subject to changing consumer preferences, such as the rise of new athletic trends or the increasing demand for sustainable products.

- Competition:The athletic footwear and apparel market is highly competitive, with several strong rivals vying for market share.

- Brand reputation:Nike’s brand reputation is crucial to its success, and any negative publicity or controversies could damage its image and impact sales.

Growth Opportunities

- Expanding into new markets:Nike has the opportunity to expand into new markets, particularly in emerging economies with growing middle classes.

- Developing innovative products:Nike can continue to invest in research and development to create innovative products that meet the evolving needs of athletes and fitness enthusiasts.

- Leveraging digital technology:Nike can leverage digital technology to enhance its customer experience, improve its supply chain efficiency, and develop new business models.

- Promoting sustainability:Nike can continue to promote sustainable practices throughout its supply chain, appealing to environmentally conscious consumers.

- Expanding its direct-to-consumer strategy:Nike can continue to expand its DTC channels to gain more control over its distribution and customer relationships.

Summary of Risks and Opportunities

| Risk | Opportunity |

|---|---|

| Supply chain disruptions | Expanding into new markets |

| Economic downturns | Developing innovative products |

| Changing consumer preferences | Leveraging digital technology |

| Competition | Promoting sustainability |

| Brand reputation | Expanding its direct-to-consumer strategy |

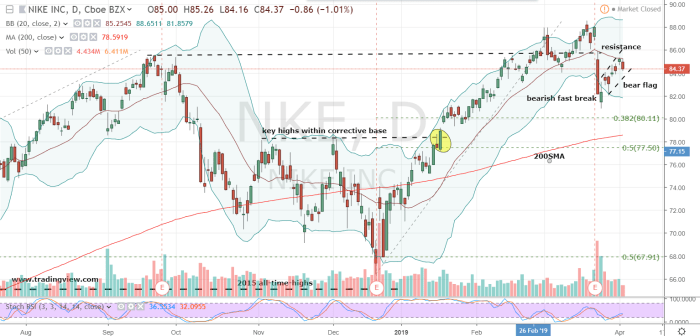

Valuation and Investment Considerations

Nike’s stock valuation can be analyzed using various methodologies.

Valuation Methodologies

- Discounted cash flow (DCF) analysis:This method involves forecasting Nike’s future cash flows and discounting them back to present value using a discount rate that reflects the company’s risk profile.

- Comparable company analysis:This method involves comparing Nike’s valuation metrics, such as price-to-earnings ratio (P/E) and price-to-sales ratio (P/S), to those of similar publicly traded companies.

- Precedent transaction analysis:This method involves analyzing the valuation of similar companies that have been acquired in recent transactions.

Current Stock Valuation

Nike’s stock is currently trading at [insert current stock price and valuation metrics, such as P/E ratio and P/S ratio].

Catalysts for Future Stock Price Appreciation

Several factors could drive future stock price appreciation for Nike, including:

- Continued revenue growth:Strong revenue growth driven by increasing demand for Nike’s products, particularly in emerging markets.

- Improved profitability:Continued improvements in profitability through operational efficiency and pricing power.

- Successful implementation of strategic initiatives:Successful execution of Nike’s strategic initiatives, such as its focus on digital commerce, sustainability, and direct-to-consumer channels.

- Favorable macroeconomic conditions:A strong global economy and favorable consumer spending patterns could boost demand for Nike’s products.

Catalysts for Future Stock Price Depreciation

Several factors could lead to future stock price depreciation for Nike, including:

- Economic downturn:A significant economic downturn could lead to reduced consumer spending on discretionary items like athletic footwear and apparel.

- Increased competition:Increased competition from existing rivals or new entrants could erode Nike’s market share and profitability.

- Supply chain disruptions:Persistent supply chain disruptions could lead to production delays, higher costs, and lower profitability.

- Negative brand publicity:Negative publicity or controversies could damage Nike’s brand reputation and impact sales.

Investment Risks and Rewards

Investing in Nike stock offers both potential rewards and risks:

- Rewards:Potential for capital appreciation driven by Nike’s strong brand, global reach, and innovative products.

- Risks:Potential for stock price volatility due to factors such as economic downturns, competition, and changing consumer preferences.