Nike Stock Overview

Nike, Inc. is a multinational corporation that designs, develops, markets, and sells footwear, apparel, equipment, accessories, and services worldwide. The company is headquartered in Beaverton, Oregon, and its core business operations revolve around athletic and sports-related products. Nike stock is traded on the New York Stock Exchange under the ticker symbol NKE.

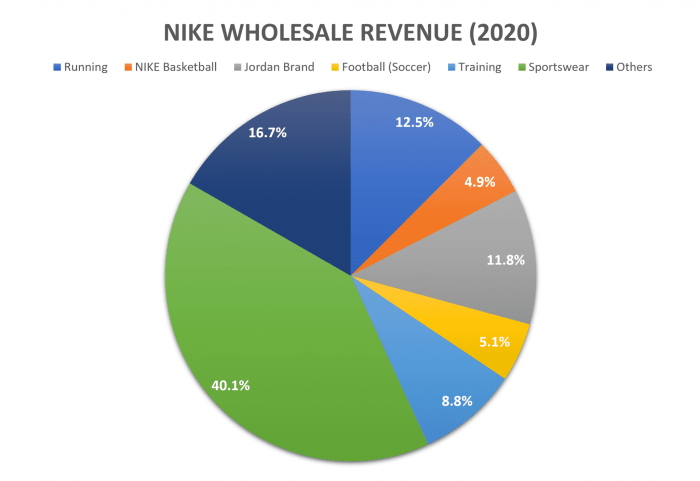

As of [Current Date], Nike’s market capitalization is approximately [Current Market Cap] USD, making it one of the largest and most valuable companies in the world. Nike operates within various industry sectors, including:* Apparel and Footwear:This is Nike’s primary business segment, encompassing the design, manufacturing, and distribution of athletic shoes, clothing, and accessories.

Sporting Goods

Nike also manufactures and sells a range of sporting equipment, including basketballs, soccer balls, and golf clubs.

Retail

Nike operates its own retail stores globally, as well as online channels for selling its products directly to consumers.

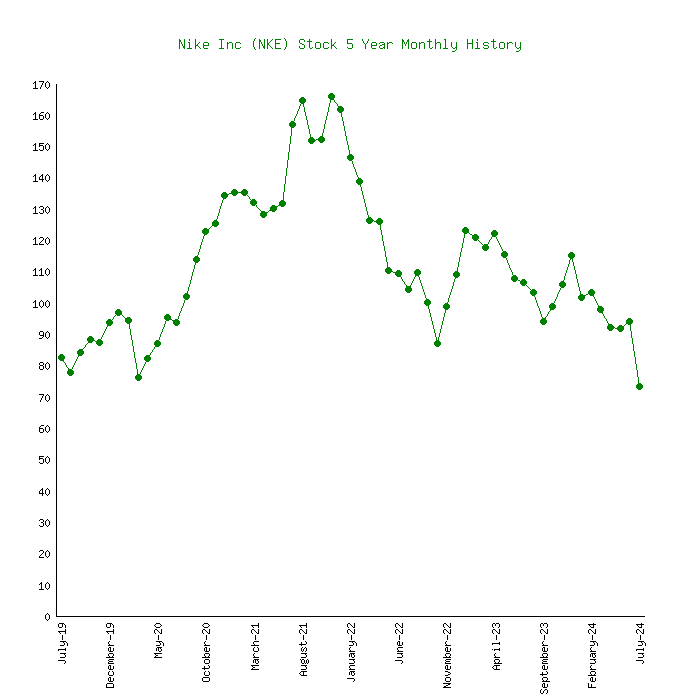

Historical Performance and Trends

Nike stock has consistently delivered strong returns to investors over the past five years. [Insert data on stock performance]. The stock price has generally followed an upward trend, with periodic fluctuations driven by various factors. Some of the key trends observed in Nike’s stock price include:* Strong Brand Recognition:Nike enjoys a strong brand reputation and global recognition, which has consistently contributed to its stock performance.

Innovation and Product Development

Nike’s continuous innovation and introduction of new products have been a major driver of growth and investor confidence.

Expansion into Emerging Markets

Nike has been actively expanding its presence in emerging markets, which has fueled revenue growth and boosted its stock price.When comparing Nike’s stock performance against its major competitors, such as Adidas, Puma, and Under Armour, Nike has generally outperformed its rivals in terms of both revenue growth and stock price appreciation.

Financial Analysis

Nike’s recent financial statements demonstrate its strong financial position and consistent profitability. [Insert data on financial performance].* Revenue:Nike’s revenue has consistently increased in recent years, driven by strong demand for its products and expansion into new markets.

Profit Margins

Nike maintains healthy profit margins, indicating its ability to manage costs effectively and generate significant profits.

Earnings per Share

Nike’s earnings per share have also shown steady growth, reflecting its strong profitability and shareholder value creation.Nike’s debt levels are manageable, and the company generates significant cash flow from its operations. This strong financial foundation provides a solid basis for future growth and investment.

Key Drivers of Stock Value

Several key factors drive Nike’s stock value, including:* Consumer Demand and Brand Loyalty:Nike’s strong brand loyalty and consumer demand are fundamental drivers of its stock value. Consumers consistently seek out Nike products for their quality, performance, and style.

Technological Advancements and Innovation

Nike’s commitment to technological advancements and innovation in product design, manufacturing, and marketing plays a crucial role in maintaining its competitive edge and driving stock value.

Global Economic Conditions and Currency Fluctuations

Global economic conditions and currency fluctuations can impact Nike’s business operations and stock value.

Competitive Landscape

Nike faces intense competition in the athletic apparel and footwear market from several key players, including:* Adidas:A global competitor with a strong presence in sports apparel and footwear.

Puma

A German sportswear company with a focus on performance and lifestyle apparel.

Under Armour

An American sportswear company known for its performance apparel and footwear.While Nike holds a significant market share, its competitors continue to challenge its position through innovation, marketing strategies, and price competitiveness. Nike’s strengths lie in its strong brand recognition, global distribution network, and innovative product development.

However, it faces challenges from rising competition, fluctuating raw material costs, and potential economic downturns.

Future Outlook and Growth Potential

Nike’s long-term growth prospects remain strong, driven by several factors:* Growing Global Demand for Athletic Apparel and Footwear:The global market for athletic apparel and footwear is expected to continue expanding in the coming years, providing opportunities for Nike to grow its revenue.

Expanding into New Markets

Nike has opportunities to expand its presence in emerging markets, where demand for athletic apparel and footwear is increasing.

Digital Transformation

Nike is embracing digital transformation to enhance its customer experience, improve its supply chain, and expand its reach.However, Nike faces potential risks and challenges, including:* Intensifying Competition:The athletic apparel and footwear market is becoming increasingly competitive, which could impact Nike’s market share and profitability.

Economic Downturns

Economic downturns could impact consumer spending and affect demand for Nike’s products.

Supply Chain Disruptions

Global supply chain disruptions could affect Nike’s ability to manufacture and distribute its products.Overall, Nike’s strong brand, innovative products, and global reach position it well for continued growth and success in the future. The company’s investment attractiveness is supported by its solid financial performance, strong brand loyalty, and ongoing efforts to adapt to evolving consumer preferences and market trends.