Cisco Systems Overview

Cisco Systems, Inc. is a multinational technology conglomerate headquartered in San Jose, California. It is a leading provider of networking hardware, software, and services, playing a pivotal role in shaping the global internet infrastructure. Founded in 1984, Cisco has a rich history of innovation and growth, evolving from a small startup to a global powerhouse.

History and Evolution

Cisco’s journey began with the development of a revolutionary networking device called the “router,” which enabled seamless communication between different types of networks. This breakthrough paved the way for the internet’s widespread adoption and transformed the way people connect and share information.

Over the years, Cisco expanded its product portfolio to encompass a wide range of networking solutions, including switches, wireless access points, security appliances, and data center infrastructure.

Core Business Segments and Key Product Offerings

Cisco’s core business segments are:

- Networking:This segment comprises Cisco’s traditional networking hardware, including routers, switches, and wireless access points. These products are essential for connecting devices and networks, enabling data transmission and communication.

- Security:Cisco offers a comprehensive suite of security solutions designed to protect networks and data from cyber threats. These solutions include firewalls, intrusion prevention systems, and endpoint security software.

- Collaboration:Cisco’s collaboration solutions empower teams to communicate and collaborate effectively, regardless of location. These solutions include video conferencing systems, unified communications platforms, and cloud-based collaboration tools.

- Data Center:Cisco provides a wide range of products and services for data center environments, including servers, storage systems, and virtualization software. These solutions enable businesses to manage and optimize their data center infrastructure.

Market Position and Competitive Landscape

Cisco is a dominant player in the networking market, holding a significant market share globally. The company faces competition from a wide range of players, including established technology giants like Juniper Networks, Huawei, and Arista Networks, as well as emerging cloud providers like Amazon Web Services (AWS) and Microsoft Azure.

Cisco’s competitive advantage lies in its extensive product portfolio, strong brand recognition, and global reach. However, the company faces challenges from the growing adoption of cloud computing and the increasing competition in the networking market.

Financial Performance Analysis

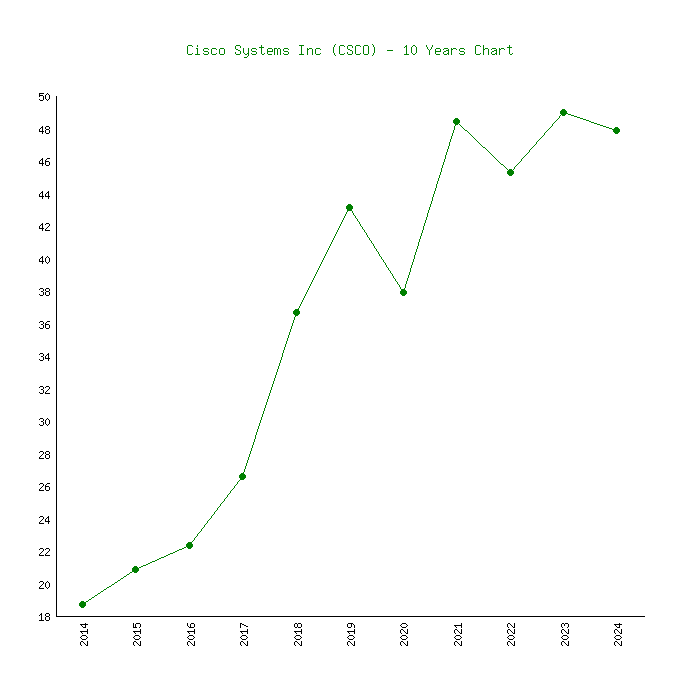

Cisco’s financial performance has been generally strong over the years, reflecting its dominant market position and consistent innovation. However, the company has faced challenges in recent years, driven by factors such as the global economic slowdown, the rise of cloud computing, and intense competition.

Revenue, Earnings, and Profitability Trends

Cisco’s revenue has grown steadily over the past decade, with a slight dip during the 2008-2009 financial crisis. The company’s earnings have also been generally strong, although they have been impacted by factors such as acquisitions, restructuring charges, and tax adjustments.

Cisco’s profitability, measured by metrics such as gross margin and operating margin, has remained relatively stable, indicating its ability to control costs and maintain a healthy profit margin.

Key Financial Ratios and Metrics

Several key financial ratios and metrics are relevant to Cisco’s stock valuation, including:

- Price-to-Earnings (P/E) Ratio:This ratio compares the company’s stock price to its earnings per share, providing insights into the market’s valuation of Cisco’s earnings potential.

- Price-to-Sales (P/S) Ratio:This ratio compares the company’s stock price to its revenue per share, indicating the market’s valuation of Cisco’s revenue generation capacity.

- Return on Equity (ROE):This metric measures the company’s profitability relative to its shareholders’ equity, reflecting the efficiency with which Cisco utilizes its shareholders’ investment.

- Debt-to-Equity Ratio:This ratio indicates the proportion of debt financing relative to equity financing, providing insights into Cisco’s financial leverage and risk profile.

Comparison to Peers and Industry Benchmarks

Cisco’s financial performance is generally in line with its peers in the networking and technology industries. However, the company’s valuation metrics, such as its P/E ratio, may vary depending on factors such as market sentiment and growth expectations. Comparing Cisco’s financial performance to its peers and industry benchmarks can provide valuable insights into its relative valuation and competitive position.

Growth Drivers and Opportunities

Cisco’s future growth prospects are driven by several key factors, including the ongoing digital transformation, the increasing adoption of cloud computing, and the growing demand for networking and security solutions.

Key Growth Drivers

- Digital Transformation:Businesses are increasingly embracing digital technologies to improve efficiency, enhance customer experiences, and gain a competitive edge. This trend drives demand for networking, security, and collaboration solutions, creating growth opportunities for Cisco.

- Cloud Computing:The adoption of cloud computing continues to grow rapidly, creating demand for networking and security solutions that enable businesses to manage their cloud infrastructure effectively. Cisco is well-positioned to capitalize on this trend through its cloud-based products and services.

- Internet of Things (IoT):The proliferation of connected devices and sensors is driving the growth of the IoT market, creating demand for networking and security solutions that can manage and secure these devices. Cisco is actively developing IoT solutions and expanding its presence in this growing market.

Emerging Technologies and Trends

Cisco is actively exploring emerging technologies and trends that present opportunities for growth, including:

- Artificial Intelligence (AI):AI is transforming industries by automating tasks, improving decision-making, and enhancing customer experiences. Cisco is integrating AI into its products and services to enhance network performance, security, and automation.

- 5G Networks:The rollout of 5G networks promises faster speeds, lower latency, and increased capacity, creating opportunities for Cisco to provide networking solutions for 5G infrastructure and applications.

- Edge Computing:Edge computing brings data processing and storage closer to users, reducing latency and improving performance. Cisco is developing edge computing solutions to support the growing demand for decentralized computing.

Market Expansion Strategies and New Product Development Initiatives

Cisco is pursuing several strategies to expand its market reach and drive growth, including:

- Acquisitions:Cisco has a history of acquiring companies to expand its product portfolio, enter new markets, and enhance its technological capabilities.

- Partnerships:Cisco collaborates with a wide range of partners, including technology providers, service providers, and system integrators, to expand its market reach and deliver comprehensive solutions to customers.

- Product Development:Cisco continues to invest in research and development to innovate and develop new products and services that meet the evolving needs of its customers.

Risks and Challenges

Cisco faces several risks and challenges that could impact its future performance, including:

Major Risks and Challenges

- Economic Slowdown:A global economic slowdown could reduce corporate spending on technology, impacting Cisco’s revenue and profitability.

- Competition:Cisco faces intense competition from established technology giants and emerging cloud providers, which could erode its market share and profitability.

- Technological Disruption:The rapid pace of technological innovation could render Cisco’s existing products and services obsolete, requiring the company to adapt and invest in new technologies.

- Cybersecurity Threats:Cybersecurity threats are becoming increasingly sophisticated, posing a significant risk to Cisco’s business and reputation.

- Supply Chain Disruptions:Global supply chain disruptions, such as those caused by pandemics or geopolitical events, could impact Cisco’s ability to manufacture and deliver its products.

Potential Impact of Economic Conditions, Competition, and Technological Disruption

Economic downturns can significantly impact technology spending, leading to a decline in demand for Cisco’s products and services. Intense competition from established and emerging players can erode Cisco’s market share and profitability. Technological disruption can make Cisco’s existing products and services obsolete, requiring the company to adapt and invest in new technologies to remain competitive.

Company’s Ability to Mitigate Risks and Adapt to Changing Market Dynamics

Cisco has a track record of adapting to changing market dynamics and mitigating risks. The company has a strong financial position, a diversified product portfolio, and a global presence, which provides it with resilience in the face of economic and market challenges.

Cisco is also investing in research and development to innovate and develop new technologies that will enable it to compete in the evolving technology landscape.

Valuation and Investment Considerations

Evaluating Cisco stock as an investment opportunity requires a comprehensive analysis of its financial performance, growth prospects, risks, and valuation.

Valuation Methods

Several valuation methods are commonly used for Cisco stock, including:

- Discounted Cash Flow (DCF) Analysis:This method projects future cash flows and discounts them back to present value, providing an estimate of the intrinsic value of Cisco’s stock.

- Comparable Company Analysis:This method compares Cisco’s valuation metrics, such as its P/E ratio and P/S ratio, to those of its peers in the networking and technology industries.

- Precedent Transactions Analysis:This method analyzes the valuation of similar companies that have been acquired in the past, providing insights into potential acquisition premiums and market multiples.

Current Valuation and Comparison to Historical Trends and Peer Valuations

Cisco’s current valuation is influenced by factors such as market sentiment, growth expectations, and risk perception. Comparing Cisco’s current valuation to historical trends and peer valuations can provide insights into its relative attractiveness as an investment opportunity.

Key Factors to Consider

When evaluating Cisco stock as an investment opportunity, it is essential to consider factors such as:

- Financial Performance:Analyze Cisco’s revenue, earnings, profitability, and key financial ratios to assess its financial health and growth potential.

- Growth Prospects:Evaluate Cisco’s growth drivers, emerging technologies, and market expansion strategies to assess its future growth potential.

- Risks and Challenges:Identify and assess the major risks and challenges facing Cisco, including economic conditions, competition, and technological disruption.

- Valuation:Compare Cisco’s current valuation to historical trends and peer valuations to determine its relative attractiveness as an investment opportunity.

- Management Team:Evaluate the experience, expertise, and track record of Cisco’s management team to assess their ability to execute the company’s strategic plan.

- Investor Sentiment:Analyze recent investor sentiment towards Cisco stock, including social media buzz and news coverage, to gauge market expectations.

Technical Analysis

Technical analysis is a method of forecasting future price movements based on historical price data and trading patterns. It can provide insights into potential support and resistance levels, as well as potential trading opportunities.

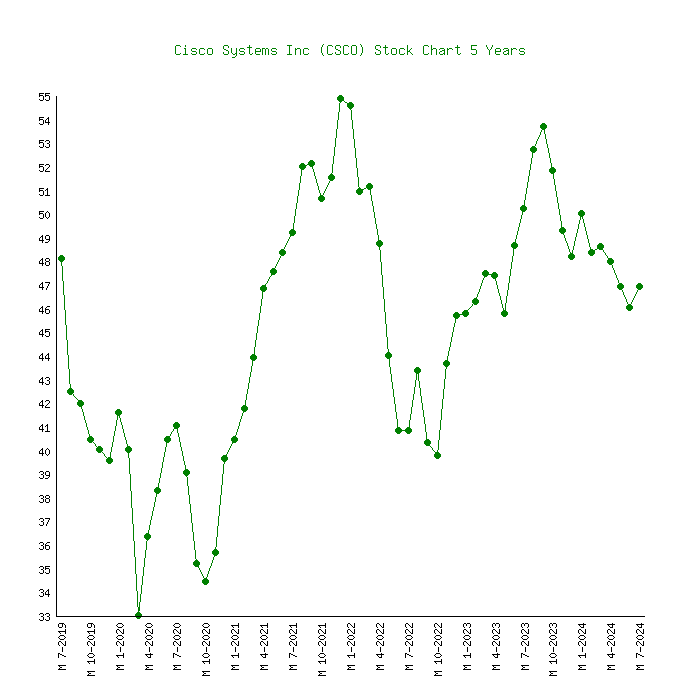

Price Charts, Moving Averages, and Other Technical Indicators

Technical analysts use various tools and indicators to analyze price charts, including:

- Moving Averages:These are calculated by averaging a stock’s price over a specific period, providing insights into trends and potential support and resistance levels.

- Relative Strength Index (RSI):This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence):This indicator compares two moving averages to identify potential trend changes and momentum shifts.

Potential Support and Resistance Levels, as well as Potential Trading Patterns

Technical analysis can identify potential support and resistance levels, which are price levels where buying or selling pressure is expected to be strong. Identifying these levels can help traders anticipate potential price reversals or breakout opportunities.

Implications for Short-Term and Long-Term Investment Strategies

Technical analysis can provide insights for both short-term and long-term investment strategies. Short-term traders may use technical indicators to identify potential trading opportunities, while long-term investors may use them to confirm trends and identify potential entry and exit points.

Analyst Opinions and Ratings

Analysts covering Cisco stock provide insights into the company’s financial performance, growth prospects, and valuation. Their opinions and ratings can influence investor sentiment and stock performance.

Consensus View of Analysts

The consensus view of analysts covering Cisco stock reflects the collective opinion of these experts on the company’s future prospects. This view is often summarized by a “buy,” “hold,” or “sell” rating, along with a price target, which represents the analyst’s estimate of the stock’s fair value.

Comparison and Contrast of Different Analyst Ratings and Price Targets

Different analysts may have varying opinions on Cisco’s prospects, leading to different ratings and price targets. Comparing and contrasting these opinions can provide insights into the range of expectations for the company’s future performance.

Potential Impact of Analyst Opinions on Cisco’s Stock Performance

Analyst opinions can influence investor sentiment and stock performance. Positive analyst ratings and high price targets can boost investor confidence and drive stock prices higher, while negative ratings and low price targets can have the opposite effect.

Investor Sentiment and News

Investor sentiment and news coverage can significantly impact stock prices. Understanding these factors can provide insights into short-term and long-term market trends.

Recent Investor Sentiment Towards Cisco Stock

Investor sentiment towards Cisco stock can be gauged by analyzing social media buzz, news coverage, and investor surveys. Positive sentiment can drive stock prices higher, while negative sentiment can lead to price declines.

Key News Events and Announcements that Have Impacted Cisco’s Stock Price

Major news events and announcements, such as earnings reports, product launches, acquisitions, and regulatory changes, can have a significant impact on Cisco’s stock price. Analyzing these events can help investors understand the factors driving stock price movements.

Potential Influence of Investor Sentiment on Short-Term and Long-Term Market Trends

Investor sentiment can influence both short-term and long-term market trends. Short-term price fluctuations can be driven by news events and sentiment shifts, while long-term trends are often shaped by fundamental factors such as earnings growth and valuation.