Understanding Financial Planner Needs

Financial planners play a crucial role in helping individuals and families achieve their financial goals. They provide expert advice on investments, retirement planning, insurance, and other financial matters. To effectively manage their client relationships and provide personalized financial guidance, financial planners need a robust CRM system that can streamline their operations and enhance their productivity.

Essential CRM Features for Financial Planners

A CRM designed for financial planners should offer specific features that cater to their unique needs. These features include:

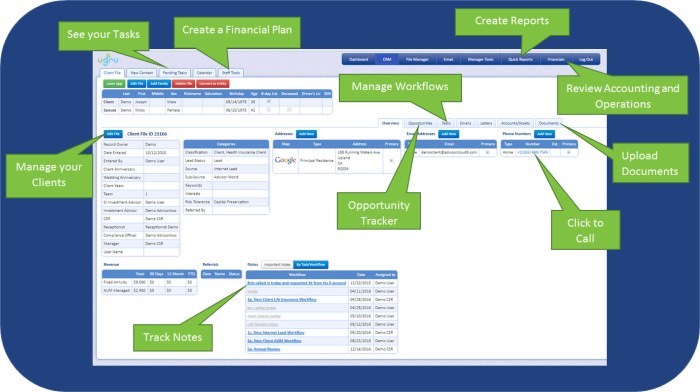

- Contact Management:A comprehensive contact management system allows financial planners to store and organize client information, including contact details, financial goals, investment preferences, and other relevant data. This ensures that they have a complete picture of their clients and can tailor their services accordingly.

- Communication Tracking:Tracking all communication with clients, whether it’s emails, phone calls, or meetings, is essential for maintaining a consistent and professional relationship. A CRM with communication tracking capabilities enables financial planners to monitor interactions, identify areas for improvement, and ensure that they are providing the best possible service.

- Task Management:Financial planning often involves managing multiple tasks and deadlines. A CRM with task management features helps financial planners stay organized, prioritize tasks, and ensure that they meet all deadlines. This feature can also help with collaboration among team members, if applicable.

Key Challenges Financial Planners Face

Financial planners face several challenges in managing client relationships and data. Some of the key challenges include:

- Managing Client Data:Financial planners often work with a large number of clients, making it challenging to keep track of all their information. This can lead to errors, inconsistencies, and difficulty in providing personalized services.

- Tracking Client Interactions:Maintaining a record of all interactions with clients can be time-consuming and difficult to manage manually. This can make it challenging to understand client needs, preferences, and progress.

- Staying Organized:Juggling multiple tasks, deadlines, and client needs can be overwhelming for financial planners. This can lead to missed deadlines, errors, and a decrease in productivity.

How a CRM Can Help

A CRM system can address these challenges by providing a centralized platform for managing client data, tracking interactions, and streamlining workflows. By leveraging a CRM, financial planners can:

- Improve Efficiency:A CRM can automate many tasks, such as sending out email reminders, scheduling appointments, and generating reports. This frees up time for financial planners to focus on providing value-added services to their clients.

- Enhance Productivity:A CRM helps financial planners stay organized, prioritize tasks, and track progress towards goals. This can lead to increased productivity and better client outcomes.

- Strengthen Client Relationships:A CRM enables financial planners to personalize their interactions with clients, provide tailored advice, and build stronger relationships. This can lead to increased client satisfaction and retention.

Key CRM Features for Financial Planners

Beyond the basic CRM functionalities, financial planners need specific features that cater to their unique requirements. These features help them manage their clients’ financial portfolios, track their progress towards goals, and provide comprehensive financial planning solutions.

Client Relationship Management Features

The core of any CRM system lies in its client relationship management features. These features are essential for financial planners to effectively manage their clients and provide personalized services. Here are some key features:

- Contact Management:A robust contact management system allows financial planners to store and organize client information, including contact details, financial goals, investment preferences, and other relevant data. This ensures that they have a complete picture of their clients and can tailor their services accordingly.

- Communication Tracking:Tracking all communication with clients, whether it’s emails, phone calls, or meetings, is essential for maintaining a consistent and professional relationship. A CRM with communication tracking capabilities enables financial planners to monitor interactions, identify areas for improvement, and ensure that they are providing the best possible service.

- Task Management:Financial planning often involves managing multiple tasks and deadlines. A CRM with task management features helps financial planners stay organized, prioritize tasks, and ensure that they meet all deadlines. This feature can also help with collaboration among team members, if applicable.

- Document Management:Financial planners often need to store and manage various documents, such as client agreements, financial statements, and tax returns. A CRM with document management capabilities allows them to securely store and access these documents easily.

Financial Planning-Specific Features

To effectively manage client portfolios and provide comprehensive financial planning solutions, financial planners need CRM systems with features specifically designed for their needs. These features include:

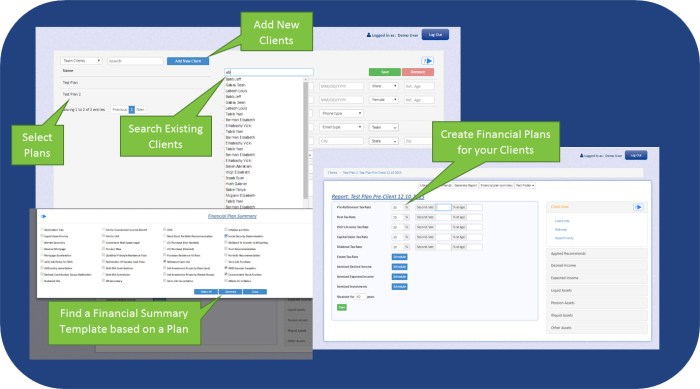

- Portfolio Management:A CRM with portfolio management capabilities allows financial planners to track their clients’ investment holdings, monitor performance, and analyze risk. This helps them make informed investment decisions and provide personalized portfolio management services.

- Goal Tracking:Financial planners help clients set and achieve their financial goals. A CRM with goal tracking features allows them to monitor progress towards these goals, provide regular updates to clients, and adjust strategies as needed.

- Financial Planning Tools:Some CRM systems offer integrated financial planning tools, such as retirement planning calculators, college savings calculators, and debt management tools. These tools can help financial planners provide clients with comprehensive financial planning solutions.

CRM Integration with Financial Planning Software

Seamless integration between a CRM system and financial planning software is crucial for streamlining workflows and improving efficiency. When a CRM integrates with financial planning software, it allows financial planners to:

- Access Client Data:Financial planners can access client data, including investment holdings and financial goals, directly from their CRM. This eliminates the need to switch between different systems and saves time.

- Automate Tasks:Integrating a CRM with financial planning software can automate tasks such as generating financial reports, sending out investment updates, and scheduling appointments. This frees up time for financial planners to focus on providing value-added services to their clients.

- Improve Decision-Making:By integrating data from both the CRM and financial planning software, financial planners can gain a comprehensive understanding of their clients’ financial situation and make more informed decisions.

Top CRM Options for Financial Planners

There are several CRM solutions specifically designed for financial planners, each offering unique features and functionalities. Here’s a comparison of some top options:

CRM Comparison Table

| CRM | Features | Pricing | User Experience | Integrations | Customer Support |

|---|---|---|---|---|---|

| CRM A | Contact management, communication tracking, task management, portfolio management, goal tracking, financial planning tools, integration with financial planning software | [Pricing details] | [User experience description] | [List of integrations] | [Customer support description] |

| CRM B | [Features list] | [Pricing details] | [User experience description] | [List of integrations] | [Customer support description] |

| CRM C | [Features list] | [Pricing details] | [User experience description] | [List of integrations] | [Customer support description] |

This table provides a general overview of the top CRM options for financial planners. It’s important to note that specific features, pricing, and integrations may vary depending on the individual plan and provider. It’s recommended to research each CRM solution thoroughly to find the best fit for your needs.

Choosing the Right CRM

Selecting the right CRM for your financial planning practice is crucial for maximizing efficiency, improving client relationships, and achieving your business goals. Here’s a checklist of factors to consider:

Factors to Consider

- Features:Ensure that the CRM offers the essential features for financial planners, including contact management, communication tracking, task management, portfolio management, goal tracking, and financial planning tools.

- Integrations:Consider the CRM’s integration capabilities with other software you use, such as financial planning software, accounting software, and email marketing platforms.

- Pricing:Choose a CRM that fits your budget and offers flexible pricing options, such as monthly subscriptions or per-user pricing.

- User Experience:Select a CRM with a user-friendly interface that is easy to navigate and understand, even for those who are not tech-savvy.

- Customer Support:Ensure that the CRM provider offers reliable customer support, including phone, email, and online resources. This is important for resolving issues and getting help when needed.

Aligning with Needs and Goals

The most important factor in choosing a CRM is aligning it with your specific needs and goals. Consider your practice size, client base, and the types of financial planning services you offer. For example, a small practice with a focus on individual clients may need a different CRM than a large firm with a diverse client base and complex portfolio management needs.

Evaluating CRM Providers

When evaluating CRM providers, consider the following tips:

- Request Demos:Schedule demos with several CRM providers to see their platforms in action and get a feel for their user experience.

- Read Reviews:Check online reviews from other financial planners to get insights into the pros and cons of different CRM solutions.

- Compare Pricing:Obtain detailed pricing information from each provider to ensure that the CRM fits your budget.

- Ask About Support:Inquire about the provider’s customer support options, including response times and availability.

Implementing and Using a CRM

Implementing a new CRM system can be a significant change for a financial planning practice. However, with proper planning and execution, the process can be smooth and successful. Here’s a guide to implementing and using a CRM effectively:

Implementation Process

- Data Migration:Transfer existing client data from your current systems to the new CRM. Ensure data accuracy and completeness.

- User Training:Provide comprehensive training to all users on the CRM’s features and functionalities. This ensures that everyone can use the system effectively.

- System Customization:Customize the CRM to meet your specific needs, such as creating custom fields, reports, and workflows.

- Go-Live:Launch the CRM system and start using it for managing client relationships and data.

Training Program

A well-designed training program is crucial for successful CRM implementation. The program should include:

- Overview of CRM Features:Provide an introduction to the CRM’s key features and functionalities.

- Hands-on Training:Offer practical exercises and scenarios to help users learn how to use the CRM effectively.

- Ongoing Support:Provide ongoing support and resources to users, such as FAQs, online tutorials, and dedicated support channels.

Maximizing Benefits

To maximize the benefits of a CRM, consider these strategies:

- Regularly Review and Update:Periodically review your CRM usage and make necessary adjustments to ensure that it continues to meet your evolving needs.

- Utilize Reporting Features:Leverage the CRM’s reporting features to track key metrics, such as client acquisition, retention, and financial performance.

- Encourage User Adoption:Promote CRM usage among all team members to ensure that everyone is on board and using the system effectively.

Benefits of Using a CRM for Financial Planners

Investing in a CRM system can bring numerous benefits to financial planners, ultimately leading to improved client relationships, increased efficiency, and business growth.

Enhanced Client Communication and Engagement

A CRM enables financial planners to communicate with clients more effectively and efficiently. By centralizing client information and communication history, financial planners can personalize interactions, provide tailored advice, and ensure that they are addressing client needs effectively.

- Personalized Communication:A CRM allows financial planners to segment their clients based on factors such as investment preferences, financial goals, and risk tolerance. This enables them to send targeted communication and provide personalized advice.

- Improved Response Times:A CRM helps financial planners stay organized and track client interactions, ensuring that they can respond to inquiries and requests promptly. This improves client satisfaction and strengthens relationships.

- Enhanced Client Engagement:By providing regular updates, personalized recommendations, and valuable resources, financial planners can keep clients engaged and informed about their financial progress. This can lead to increased client loyalty and retention.

Increased Client Retention and Satisfaction

By providing exceptional client service and building strong relationships, financial planners can significantly increase client retention and satisfaction. A CRM plays a vital role in achieving this by:

- Personalized Service:A CRM allows financial planners to understand client needs and preferences, enabling them to provide personalized service and tailored advice. This fosters trust and strengthens client relationships.

- Proactive Communication:A CRM helps financial planners stay organized and track client interactions, enabling them to proactively address concerns, provide updates, and offer support. This demonstrates a commitment to client satisfaction.

- Improved Client Experience:By streamlining workflows and providing a seamless client experience, financial planners can create a positive impression and build lasting relationships. This can lead to increased client retention and referrals.

Business Growth and Goal Achievement

A CRM can be a powerful tool for financial planners looking to grow their business and achieve their goals. By improving efficiency, enhancing client relationships, and providing valuable insights, a CRM can help financial planners:

- Increase Revenue:By improving client retention, attracting new clients, and increasing productivity, a CRM can help financial planners grow their revenue and profitability.

- Expand Market Reach:A CRM can help financial planners identify new client segments and target them effectively with personalized marketing campaigns. This can lead to increased market reach and business growth.

- Achieve Business Goals:By providing a clear picture of client relationships, financial performance, and business operations, a CRM can help financial planners track progress towards their goals and make informed decisions.