This article delves into the significance of Net Present Value (NPV) in assessing investment projects and business decisions. NPV plays a crucial role in financial evaluations by considering factors such as the time value of money, risks, and potential returns. Understanding the definition, types, calculations, formulas, interpretations, examples, and overall importance of NPV can greatly benefit organizations in making informed and strategic financial decisions. Explore how NPV significance can guide businesses towards maximizing their investment returns and optimizing their financial strategies.

Definition of Net Present Value (NPV)

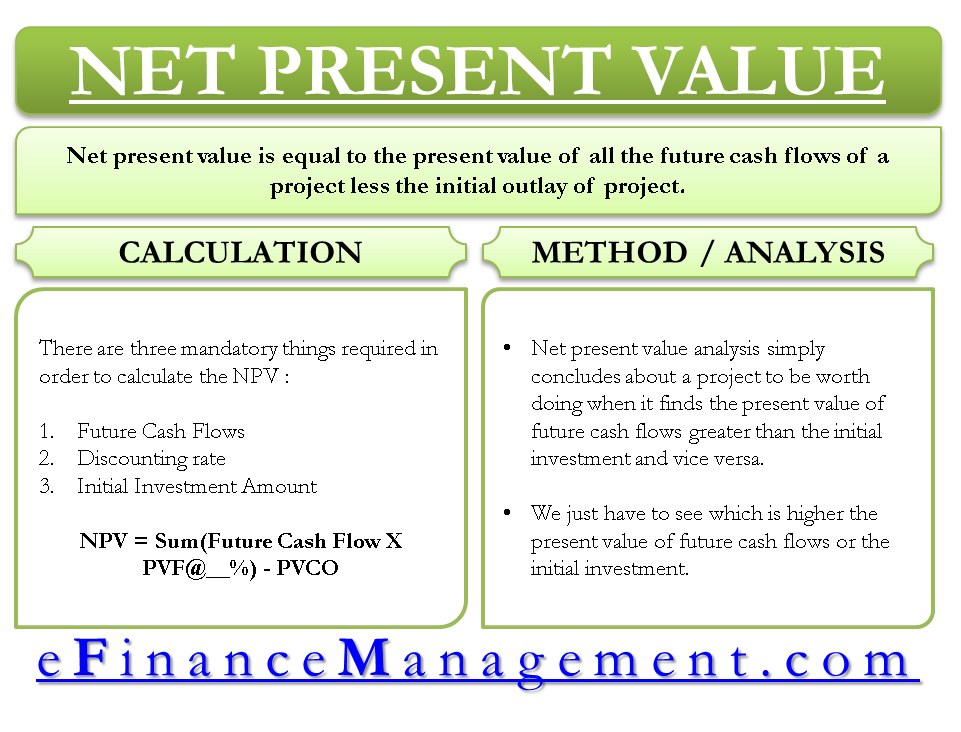

Net Present Value (NPV) significance lies in its role as a critical financial tool used by business professionals to assess the potential profitability of investment projects. By considering the future cash flows of a project and discounting them to their present value, NPV offers a robust framework to evaluate the financial viability of proposed ventures.

This method goes beyond simplistic assessments, delving into the intricate details of a project’s expected cash flows over time. By discounting these cash inflows and outflows to their present value, NPV accounts for the time value of money, providing a comprehensive analysis that aids decision-makers in determining whether an investment is financially sound.